This is a h2 title

rgergrgrgrgergergf

fgrgrgdsf dsf

This is a h3 title

fdfdf

The convenience of online shopping has revolutionized the way we make purchases, allowing us to browse, compare prices, and order products from the comfort of our homes. However, with this convenience comes the risk of falling victim to various online scams, and one of the most prevalent among them is non-delivery fraud. The Scam Directory shows you the world of non-delivery fraud websites, exploring what they are, how they operate, and most importantly, how you can protect yourself from becoming a victim.

Understanding Non-Delivery Fraud

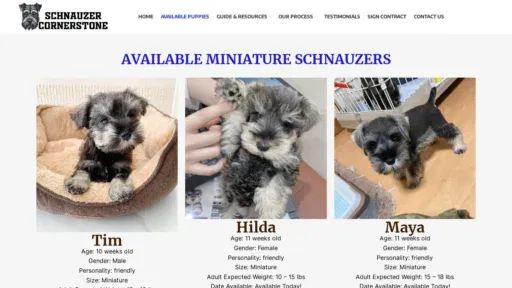

Non-delivery fraud, also known as online shopping scams or order scams, occurs when a consumer pays for goods or services online but never receives the purchased items. Perpetrators of non-delivery fraud often create fake online stores, posing as legitimate businesses to lure unsuspecting customers. These fraudulent websites mimic the design and functionality of real e-commerce sites, making it challenging for consumers to distinguish between the two.

How Non-Delivery Fraud Works

- Attractive Offers: Fraudulent websites entice victims with unrealistically low prices or exclusive deals to lure them into making a purchase.

- Fake Websites: Scammers create convincing websites that mirror the appearance of well-known e-commerce platforms, complete with professional-looking product pages, logos, and payment gateways.

- Payment Scams: Victims are prompted to enter their payment information on these fake websites. Once the transaction is completed, scammers disappear without delivering the promised goods.

- Limited or No Customer Support: Non-delivery fraud websites often lack proper customer support channels or provide false contact information, making it nearly impossible for victims to seek assistance or refunds. Quiet often they will have an online chat which is there to convince you to pay, it is not for customer support.

Protecting Yourself from Non-Delivery Fraud

- Research the Website:

- Check for reviews and ratings online ignore reviews on the website itself as they will be written by the scammer..

- Verify the website’s legitimacy by looking for contact information, including a physical address and phone number.

- Check the WHOIS to make sure the registration details match the websites claims

- Use Secure Payment Methods:

- Opt for secure payment options, such as credit cards or reputable online payment platforms. These methods often offer buyer protection and the ability to dispute unauthorized transactions.

- Beware of Unrealistic Deals:

- Be skeptical of deals that seem too good to be true. If a website offers products at significantly lower prices than competitors, it could be a red flag.

- Check the Website contents:

- Look at the “About” page, terms and conditions as well as other content besides the items for sale. Scam websites either lie about how long the website has been online or omit these pages completly.

- Monitor Your Bank Statements:

- Regularly review your bank or credit card statements for any unauthorized transactions. If you notice anything suspicious, report it to your financial institution immediately.

Non-delivery fraud is a growing concern in the world of online shopping, but by staying informed and adopting vigilant practices, you can significantly reduce the risk of falling victim to these scams. Remember to conduct thorough research, use secure payment methods, and remain cautious of deals that seem too good to be true. By taking these precautions, you’ll be better equipped to enjoy the convenience of online shopping without falling prey to non-delivery fraud websites.

hhghh

This is a h4 title

This is a h5 title

| ss | sss |

| ss | sss |

| ss | sss |

| ss | ss |

| ss | sss |

ddddd

ddddd

This is a h6 title

Learn what actions to take if you’ve sent money to someone you believe is a scammer or if you’ve shared your personal information or granted access to your computer or phone to a potential scammer.

Scammers are really good at tricking people. They call, email, and text us, trying to get our money or personal info like Social Security or account numbers. If you paid a scammer, your money might be gone. But it’s still worth checking with the company you used to send the money to see if they can help you get it back. Act fast to improve your chances of getting your money back.

Did you use a credit card or debit card to make the payment?

Get in touch with the company or bank that gave you the credit or debit card. Tell them about the unauthorized charge and request them to cancel the transaction and refund your money.

Did you use a gift card for payment?

Reach out to the company that issued the gift card. Inform them that the card was used in a scam, and request a refund. Make sure to retain both the gift card and its receipt.

Did you use a company like Western Union or MoneyGram to send money via a wire transfer?

Get in touch with the company you used for the wire transfer. Let them know it was a scam, and request them to undo the transfer and return your money.

Contact details for specific companies:

- MoneyGram: Call 1-800-926-9400

- Western Union: Call 1-800-448-1492

- Ria (non-Walmart transfers): Call 1-877-443-1399

- Ria (Walmart2Walmart and Walmart2World transfers): Call 1-855-355-2144

Did you send a wire transfer through your bank?

Get in touch with your bank and let them know about the unauthorized transfer. Request them to undo the wire transfer and return your money to you.

Did you use a money transfer app to send money?

Tell the company that runs the money transfer app about the scam, and request them to undo the payment. If you connected the app to your credit card or debit card, inform your credit card company or bank about the fraud and ask them to cancel the charge.

Did you use cryptocurrency to make a payment?

When you use cryptocurrency to pay, it’s usually not possible to reverse the payment. If you want your money back, the person you paid needs to send it back to you. However, you can still try reaching out to the company you used to send the money. Let them know it was a fraudulent transaction and ask if they can undo it for you.